The narrative around Black men and fashion has fundamentally shifted. What was once framed as a niche market or cultural curiosity is now recognized as a massive economic force driving trends, defining aesthetics, and commanding unprecedented buying power. The numbers tell a story that boardrooms can no longer ignore: Black men are not just consumers of fashion—they are architects of it.

Understanding this market requires looking beyond stereotypes and surface-level trends. It demands examining purchasing patterns, cultural influence, brand loyalty dynamics, and the complex relationship between identity, expression, and commerce. This is the landscape where billion-dollar decisions get made and where brands either capture generational loyalty or become irrelevant.

The Numbers That Demand Attention

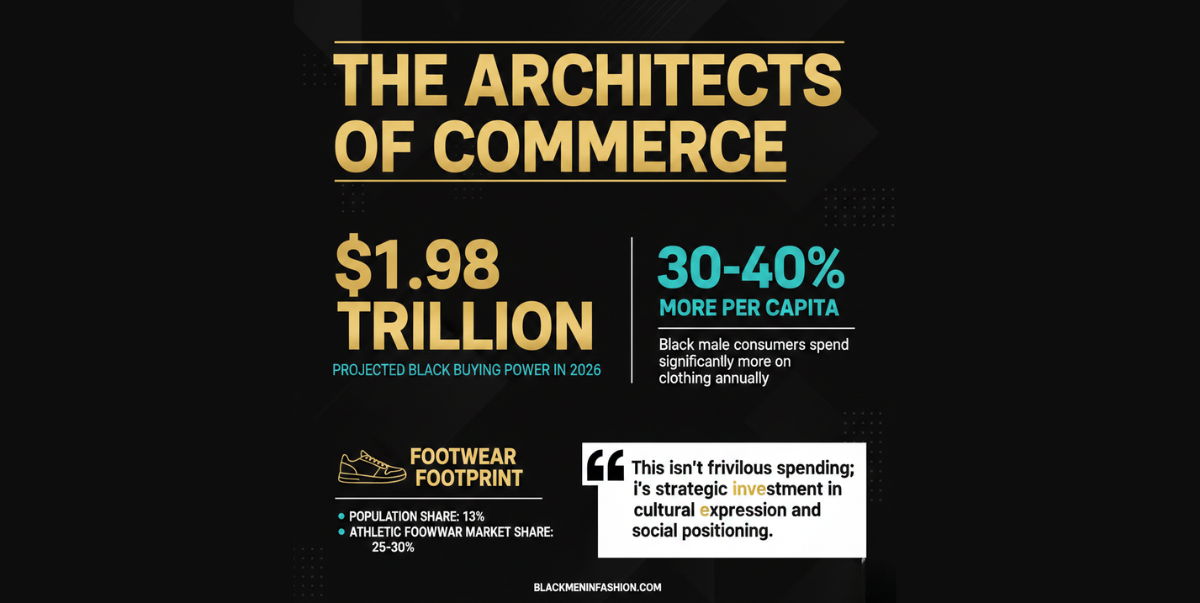

Black Americans collectively wield approximately $1.6 trillion in annual buying power as of recent estimates, with projections suggesting continued growth. While exact breakdowns by gender and category vary, research consistently shows that Black consumers allocate a higher percentage of income to apparel and footwear compared to the general U.S. population.

Black men specifically represent a demographic that punches above its weight in fashion spending. Studies indicate that Black male consumers spend significantly more on clothing annually than their white counterparts—some research suggests 30-40% more per capita. This isn’t frivolous spending; it’s strategic investment in presentation, cultural expression, and social positioning.

The footwear segment alone reveals the power of this market. Black consumers represent approximately 13% of the U.S. population but account for an estimated 25-30% of athletic footwear purchases and a disproportionate share of sneaker resale market activity. Limited-edition sneaker releases can succeed or fail based on Black male consumer reception—a reality that every major athletic brand acknowledges, even if they don’t always admit it publicly.

In menswear specifically, Black male influence extends far beyond direct purchasing. Trend-setting, brand elevation, and cultural legitimization often flow through Black men before reaching broader markets. A brand that captures Black male loyalty doesn’t just gain customers—it gains cultural capital that attracts wider audiences.

The Cultural Multiplier Effect

Black men’s relationship with fashion operates through what might be called a “cultural multiplier effect”—their influence on trends and brand perception vastly exceeds their numerical representation in the population.

How This Works: A product or brand embraced by Black male tastemakers and early adopters gains cultural legitimacy that then attracts mainstream consumers. This pattern repeats across categories from streetwear to luxury goods, from athletic apparel to formal menswear.

Consider the trajectory of brands like Supreme, Off-White, or Fear of God. While their founders and marketing didn’t exclusively target Black consumers, Black male adoption—particularly by athletes, musicians, and visible cultural figures—accelerated their ascent from niche to mainstream. The same pattern applies to heritage brands experiencing renaissance moments: Clarks, Timberland, Tommy Hilfiger, and Ralph Lauren all benefited from Black male cultural adoption that transformed them from generic to desirable.

This multiplier effect creates measurable business value. Brands can quantify the impact: when Black athletes wear specific sneakers, resale values spike. When Black musicians reference luxury brands in lyrics, those brands see search traffic increases and sales lifts in specific categories. When Black style influencers showcase particular items, those pieces sell out—a phenomenon retailers call “the co-sign effect.”

For marketers, this represents both opportunity and responsibility. The opportunity: an authentic connection with Black male consumers can transform brand trajectory. The responsibility: exploitative or performative engagement gets called out quickly and damages brand equity among all demographics, not just Black consumers.

Market Segmentation: Beyond Monolithic Thinking

The “Black men’s fashion market” isn’t monolithic—it encompasses diverse segments with distinct preferences, spending patterns, and brand relationships.

Age-Based Segments:

Gen Z and Young Millennials (18-35): Digital natives are comfortable with online purchasing, resale platforms, and direct-to-consumer brands. Heavy sneaker and streetwear consumers. Influenced by social media, hip-hop culture, and peer recommendation. More willing to experiment with gender-fluid fashion and boundary-pushing aesthetics. Value brands that demonstrate social consciousness and cultural authenticity.

Established Millennials and Gen X (35-55): Peak earning years, translating to higher spending on quality and investment pieces. Balancing professional wardrobe needs with personal style expression. Growing interest in luxury goods as wealth accumulates. More brand-loyal once relationships are established. Appreciation for heritage brands with cultural resonance alongside contemporary labels.

Boomers and Older (55+): Traditional retail shoppers, though increasingly comfortable online. Emphasis on quality, durability, and classic styles. Strong loyalty to brands that have served them well historically. Significant purchasing power from accumulated wealth. Underserved by fashion marketing that skews younger.

Income-Based Segments:

Aspirational Shoppers: Younger consumers or those with moderate incomes who strategically invest in key pieces to project success and style. Heavy users of resale markets, flash sales, and discount retailers, alongside occasional splurges on statement items. Brand-conscious but price-sensitive. Influenced by visible figures who represent an aspirational lifestyle.

Established Professionals: Comfortable incomes supporting regular purchases of quality goods. Building versatile wardrobes that work across professional and social contexts. Willing to pay a premium for superior fit, materials, and construction. Increasingly interested in Black-owned brands and cultural connection alongside mainstream luxury.

High Net Worth: Executives, entrepreneurs, athletes, and entertainers with significant disposable income. Regular luxury purchases, custom tailoring, and exclusive collaborations. Less price-sensitive, more concerned with uniqueness, quality, and brand prestige. Targets of luxury brand VIP programs and invitation-only experiences.

Geographic Segments:

Urban markets—New York, Los Angeles, Atlanta, Chicago, Houston, and Washington, D.C.—show different fashion preferences and spending patterns than suburban or rural markets. Southern cities show different brand preferences than coastal markets. International markets, particularly in Africa and the Caribbean, represent growing opportunities as economic development creates expanding middle classes.